- Portals

- The Current Year

- ED in the News

- Admins

- Help ED Rebuild

- Archive

- ED Bookmarklet

- Donate Bitcoin

Contact an admin on Discord or EDF if you want an account. Also fuck bots.

Paycoin

|

This page relies entirely on facts. Fact Cat knows this because of his learnings. Sorry for the lack of dick jokes. |

A man named Josh Garza had a dream... a dream to make all the moneys ever using Cryptocurrency and technology. This led to the creation of Peercoin Paycoin (abbreviated XPY) is the 100% original and completely revolutionary cryptocurrency "years ahead of everyone else" that has taken the exchanges by storm. It's a coin where the average miner can make a buck and keep up with the whales! A coin where you can buy in at $5 and sell back to the company at $20! A coin you can use on Amazon! It's a coin for the people!

...If by people you mean Communist Russia....

As you can imagine, the Paycoin camp comes in two flavors: SCAAAMMMM! and BEST THING EVAR! depending on if you have lost your shirt with this coin or not. The Scam camp screams about Garza's shady reputation and the fact that this really isn't an origional or innovative coin. The "BEST THING EVAR!" camp doesn't care about Garza's shady dealings and thinks the price will turn around and make it all worth it. There already is a strong class system of "regular users" and "elite users" forming based entirely on who owns the most coins. In the meantime Garza enforces his happy kingdom with shadow bans and mass post deletions even of his own posts. This is why many links in this article will lead to archives: the Urge to delete is strong with this one.

Josh Garza: Founder of GAW

Homero "Josh" Garza started as a high school failure with ADD turned Direct TV salesman with a dream of bringing low-cost cable internet to the people of New England with his band new company: Great Awk Wireless (GAW) High-Speed Internet. He talked to the Massachusetts Broadband Institute and got a $40,000 grant to add infastructure in order to bring reliable internet to the people. Thousands signed up immediately, thrilled to be on the ground floor of a brand new company run by regular people wanting to make the world a better place.

Well, nothing actually came of it. No new infastructure. No internet. Josh didn't even live in New England: he moved shortly after taking the money. He took the money and ran, rebranded GAW as "Geniuses at Work" to create his own Bitcoin mining service, ZenPortal. He started buying rigs from reliable builders on Ebay and the money started rolling in. Well, buying isn't the best word for it. He mostly bullied sellers, demanding building rights as part of purchases and used paypal to run Chargeback scams to get his money back until he had enough customers that he didn't care if he actually had to pay for rigs or not.

All the asshattery was worth it, however, as now he could offer Zenminer hashlets! The promise was that the Zenminer hashlets would always be profitable and that their Zen Hashlet would mine the world's most profitable pool: Zenpool! No more obsolete hardware or power worries, just bitcoin profits for all! People wanted more, however. More features! Boost your speed for a few hours or mine two pools at once! Be first in line for all the new upgrades! Just pay up $100 directly to GAW for a Hashlet Prime. When you're ready to upgrade all your old Hashlets to primes, just sell them on the handy dandy internal market that secretly marks your price up and gives GAW the difference.

Wait, did we say miner? We meant thing that spits out bitcoins based on how much the pool you chose is making that day paying the hashlet owner with bitcoins that other users have paid to buy their hashlets. GAW is sorry for any inconveneince in their "cloud mining service" being confused for a service that actually mines coins. It's facinating how the line that clarifies this point was removed from the Terms of Service within a day of A news post pointing it out. If paying money to join a program that pays you money created by others buying into the program sounds familiar, that's because it is the definition of a ponzi scheme.

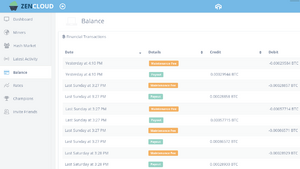

Until late January 2015 Zenminer still sold Zen hashlets for about $15 BTC directly from GAW, each of which creates only 1 satoshi per day on average. Gaw is selling off their personally owned miners for BTC and USD and will not take their own coin, XPY, for any of their products. Even with bitcoin facing a 30% market downturn from late 2014, Zen hashlets should have been giving a profit of at least 1,000 satoshi a day. In a nutshell, Zen hashlets had stopped actually mining (partly due to GAW selling off all the mining equipment) with GAW instead paying piddly coinage to encourage everyone to sell them off. Now only Hashlet Primes paid much of anything, and that was mostly because a few whales were still buying them and held a few thousand a piece at the time. Ironically, Hashlet Primes were outputting about as much in January 2015 as Zen Hashlets were outputting in Summer of 2014.

Then Bitcoin took a downturn making the ponzi scheme mining unprofitable and GAW decided to launch their own coin instead of dealing with Bitcoin mining.

All new features that were promised for Hashlets have been abandoned. Zenportal is now abandoned except for HashStakers. January 30, 2015 GAW turned off cloud mining for good. No warning was given. Naturally the reaction of the very smart Zenminer clients who could have never seen this coming was "WTF?!?" Everyone inside of Zenportal who owned any hashlets at all, even if it was a Hashlet prime, stoped making money. Zencloud's mining opperations started in August 2014 and closed down within six months of starting.

GAW buys Coinswap so even if all other exchanges turn away, he can still have people selling and trading his coin. Garza and GAW announce they are "all in" for Paycoin.

Bitcoin Miami 2015

When Garza announced that he would show up at North American Bitcoin Conference Miami, a very popular Cryptocurrency convention, reactions were mixed. Paycoin owners were estatic that Josh could come down and clear up misconceptions made by the big, mean guys on Reddit and other sites. He could answer their questions in person and get more people into the Paycoin fold! Redditors wanted to either kill Josh if the death threats were any hint, or ask him WTF he was thinking and if he was a troll, scam artist, or simply really inept at launching a cryptocurrency. Many others said they would Boycot the convention if Garza shows- something hilarious as the tickets were hundreds of dollars a piece and most people couldn't afford to go there anyway.

Garza stated that he would attend the mining panel and hold a Q&A about Paycoin afterwards. Then he bowed out of the Q&A saying he would just attend a panel. The convention came, Garza took some photos. The panel started... and Garza never showed up to anything. In fact, outside of acouple of photos, there was no evidence whatsoever that he had done anything outside of stopping by!

-

Josh at the show

-

Josh's buisness card

-

The pannel: no josh!

Glorious Paycoin!

Apparently Paycoin is built off Peercoin's wallet and blockchain with minor tweaking. Typically this would have landed Garza in a shitload of trouble for using it in a commerical application, however, legal problems are skirted by the fact that the wallet itself and all features are free even if the coin is technically owned by and distributed by a company. The major differences between Paycoin and peercoin are that Paycoin gives a 5% interest rate instead of a 1%, the interest is generated at random with higher chances given to people who hoard more coins, and there are variations on the interest rate hardcoded in the wallet so better rates are given to big investors in the coin. Oh wait, I didn't mention those?

Well, there are three classes of Paycoin owner. Normal, Orion Controller, and Prime Controller. Normal people have the crappy 5% random chance at gaining interest on held coins. Oh, and to get that 5% chance of minting something within the next 90 days you have to basically throw all your coins in a computer-based wallet which must be left running at all times and perform a vodoo ritual to make the wallet try to "mint" coins. Orion owners get up to a 15% random chance from doing the same thing and all they need to do is hoard at least 50 coins and never touch them! Prime controllers are whales who went to auction with other whales, bidding in order to get a 30% interest rate. Oh, and all the non-winners lost their bids to the company as part of the package: bids are non-refundable. Remember: the more coins you have the closer to 100% your chance of getting interest will be. So by having tons of money an Orion controller makes six times what a normal miner makes with at least a 90% chance of earning 30% extra coins every single day without having to pay anyone anything extra. So what if Prime Controllers have to rebid every six months? It's not like GAW has a stake in the huge, non-refundable bids or that Garza himself gets to be an Orion Contoller for free... Oh, wait. Never mind. For those of you not keeping track, Block 1 was 12,000,000 XPY. 12,350,000 Paycoins are in circulation as of January 21st 2015. This means that 97% of all paycoins are in huge wallets like Garza's in which they are gaining interest.

Don't beleive us about the controllers? Well, here's the Magic keys to owning an Orion Controller node from the source on Sourceforge. You should see a list of over 30 keys, if not then search for the term OP_PRIMENODE350. I can translate... that link goes to a node showing exactly what it's doing: It's giving the holders of those nodes 350%/year compounded every block. That really ends up being more like 700%/year per Prime controller as the interest applies to the current XPY value after new coins are added. Every single listed node is generating XPY at an EXPONENTIAL rate which will cause massive deflation of coin values and swift coin death due to overstock of coins. The other nodes not owned by Garza himself just connected to the internet on January 27th 2015. As soon as those nodes turn on each wallet will accumulate PoS days and be handed millions of XPY over the coming months, all of which will be most likely dumped on the market as swiftly as possible. By the way, it's easy to spoof being a Prime controller node. Here's the magic words for you: vSeeds.push_back(CDNSSeedData("someaddress.com or IPaddy", "someaddress.com"));

As you can see, this coin can't be mined with equipment like Bitcoin or Litecoin can. Don't despair, little miner! With this coin what you do is buy a Hash Staker! Hash Stakers are purchased directly through GAW for Bitcoin or USD (Gaw won't touch XPY), then you add a paycoin to your fancy new staker and then you can make money guarenteed every day at 5% for however long your Staker lasts. Oh, yeah, those Hash Stakers expire when their time is up. You are going for a limited-time Certificate of Deposit that actually costs money to purchase before you even put in your personal stake to gather interest. By the way, Hash Stakers that last longer or can hold more than 1 Paycoin cost extra. Gaw says that “everyone who owns one will be profitable.” Take it from a GAW forum member as to what a great value this is!

At the current exchange rate ($4) and slightly less than 1% daily payout HashStakers would not recover the $10-$20 cost:

At $5 exchange rate the payout is less than $0.05 per day, or less than $4.50 per 90 days. 90-day HashStaker cost between $10-12.

At $5 exchange rate the payout is less than $0.05 per day, or less than $9.00 per 180 days. 180-day HashStaker cost between $18-20.

The exchange rate would need to stay above $10 for HashStaker owners to break even.

Ok, now you have your Paycoin, what to do with it? Take it to Paybase!

Paybase

Paybase is the base hub for all Paycoin transactions. You can buy/sell XPY for bitcoin, credit cards, or cash without verification, use it at 10,000 retailers including Walmart and Amazon, use it to pay your bills, or stake it at 5% just like a normal user can with their wallet. Paybase even would allow a "20 dollar floor price" that would be enforced by GAW and Paybase. Or at least that's what GAW promised.

Before things even got off the ground there already was a class system setting up for Paybase: regular accounts, premier accounts, and Paycoin Ambassadors. Only premier and ambassador accounts wil get to earn interest but they must have a "positive buy-to-sell ratio, and hold above a certain XPY balance in Paybase". Considering that orion controllers have at least 50 XPY in wallet to be Orion, one can gather this means you will need to have at least 50 XPY in your wallet at all times and to have purchased most of your XPY directly from Paybase/GAW in order to get anything. So you used HashStakers and exchanges to get your coins? Tough titty said the kitty!

20 Dollar Launch floor!

Paybase ended up being released as an "open Beta" even though it did not say so anywhere on the site for over a month. The only feature active on launch was the ability to trade XPY for BTC and the ability to hold XPY without any ability to earn interest on it. There also was a huge honking security breach on day one that allowed people to see inside eachother's accounts, complete with their Paycoin addresses. People raged. Where were any of the promised features?

Garza, seeing that the floor price wasn't $20, tried to raise the price of the coin by setting a HUGE buy order on Cryptsy at $20 and waiting. Note how he isn't using his own product again by buying at Cryptsy eventhough he owns Coin Swap. Apparently he had never heard of "pump and dump" before, as such a sudden price spike due to only one real buyer is exactly what causes a pump and dump scenario. One guy pumps the price up, all the sellers see the price rocket up suddenly with little to no reason, so they dump their coins at profit. Oh, and the guy who pumped the coin prices? He dumps, too, and makes the biggest profit of them all. The down side of a pump and dump is that it decimates the coin price when it's done. Paycoin reached record lows within a day. This only made people more angry!

After seeing firsthand that a pump and dump (shocker!) isn't the way to make a coin price rise in a stable fashion, Garza called all the people who sold that day "trolls" and declared a "troll hunt" on them. Garza claims he "held" his coins, but if that is true then there's a whole lot of people who really, really just wanted their $20 and to get the fuck out. Soon after the pump and dump mistake, Garza learns that technically it's illegal to create a coin just to manipulate the values yourself, so he stops pumping entirely. Price fall even further.

Buy with Fiat or Credit Cards!

Over a week after paycoin is released, Paybase finally has Credit and Debit Card payment options via Stripe. Oh, as Stripe doesn't allow people to buy and sell Crypto, this feature went down within four hours of Launch. Garza had to get on the phone with stripe and beg for them to allow his company to violate Stripe's TOS. Well, it didn't work: Garza had to change credit processors to a "high-risk" credit card handler and now pays the same insane fees that porn companies have to pay to credit card companies. People bitch about the high credit card fees and are ignored. However, the new processor takes one look at all the chargebacks made by people unhappy that the price of XPY is falling like a stone and drops them. Boom- No more credit cards on paybase!

With credit cards shut down (again) Garza takes some of the code from CoinSwap, rips it out, and tosses it on Paybase. This was done without any warning of it coming whatsoever, leading to people having tons of XPY to sell and nobody having (or possibly wanting) BTC to spend on buying XPY. With everyone selling and nobody buying the price plummeted nearly instantly causing the system to break. This caused GAW to lock all funds sent through the exchange at the time to "refund" them, reversing all transations that happened until the buy list actually got some people in it. If this wasn't bad enough, as soon as the exchange was up and running it quickly became apparent that it was a broken mess that glitched constantly. Those who complained got bans for their effort. Also, those who deposited BTC soon found they couldn't withdraw BTC from paybase at all. The withdraw function was broken effectively turning Paybase's "exchange" into a money funnel.

Use your Paycoins with Amazon and other merchants!

The next feature promised was "Merchant intergration". It was planned to be just a Browser Addon called ZincSave that GAW bought, tweaked to accept XPY, and renamed "PaySave". In short, there are zero partnerships with major retailers in play. In fact, Walmart, Amazon, and Target have all denied having connections with GAW at all in repeated phone calls from curious investors who were looking forward to using their Paycoin, but skeptical than an upstart business would have this much clout.

After realizing "oh shit- we can't use Zincsave Paysave or Amazon will sue our asses", they instead came out with Payflash. And what was this marvellous invention? It was a frontend to a pre-existing service called Gyft that basically would take the Paycoins, dump them for BTC, then use the BTC on Gyft to buy giftcards. Well, anyone with half a brain would know what when massive numbers of coins get dumped into an exchange for BTC, the price of the dumped coin falls like a stone. Sure enough, this wonderfully well thought out new feature caused the price of XPY to fall to historic lows.

It was pulled from the site within an hour. This frustrated users who were already feeling duped at having all other features wither fail or just plain not be what it said it would, which in-turn made angry whales create walls of thousands of XPY to prevent the price from rising again.

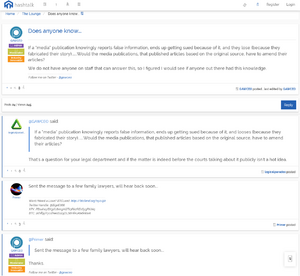

Trust Josh or else

On january 21st 2015 Coinfire and Ars Techica said they had recieved a leak that The SEC was going to investigate Garza and Gaw! THat's right: the heavy-handed deletion fests, the broken promises, the refusal to accept their own cryptocurrency, and other clear signs that had made Reddit scream "SCAM!" had also gotten the feds attention and made them think "securities fraud". A call out to the world was made: report what you know to the SEC if you think it's a scam! Of couse Paycoin owners quickly decried the leak as false, however, it really is more of a self-fulfilling prophecy. If Paycoin really is a scam and people report enough info, the investigation may happen even if it wasn't really under way when the news was posted.

Further incrimidating evidence surfaced that although GAW has registered Paybase federally, it has failed to register with the states. The problem with this is that any company working in all 50 states, especially when it comes to orginizations that handle currency or property like Paycoin, need to register with and be accepted by each state seperately as well as having a federal registration accepted before even starting a national business. This is important in order for Paybase to be able to declare state taxes and be accuratenly counted within each state's banking and property laws. Paybase, and Paycoin by extension, are working illegally without state acceptances.

Users started to panic. So far all Paybase delivered was a broken money funnel of an exchange that can accept coins but not send them and it looked like even the government was smelling something fishy. Many users still had funds frozen from the "reversal". All other features were gone after only barely working at all. Meanwhile Josh and crew were MIA since the Bitcoin Miami convention- a convention they failed to make a showing at. Fearing the worst, one user went back and read the brand new, edited terms of Service GAW set up for it's Paycoin and Paybase products.

4.3 Risk that Paycoin May Never be Completed or Released. Purchaser understands that, while the Company will make reasonable efforts to complete the Paycoin software, it is possible that an official completed version of Paycoin may not be released and there may never be an operational Paycoin, Prime Controller, or HashStaker.

4.4 Paycoins May Have No Value. Paycoin is a new cryptocurrency and its value is determined by supply and demand. At any point after its release, it is possible that the market price of a Paycoin may be zero. Because the value of Paycoin may be zero, the value of a stake, in Paycoins, from a HashStaker may also be zero.

In regular people speak: trust josh or get out of Paycoin while you still can.

Reactions by other companies

Shapeshift (a company that does fast and easy cryptocurrency trades) took one look at GAW, smelled a rat, and dropped them. In their words: "...not only did Garza not fulfill his promise to back the value of Paycoin at $20 per coin, but himself and his administrators seem to be actively re-writing history, scrubbing their forum of any mention of that promise. This moves it from fool's errand to the realm of deception."

In response to Shapeshift running away, Garza re-launched the $20 buyback promise with a few new caveats to prevent the hammer of the law from falling on him:

- Users WILL need to verify identity to use it

- The buyback will be in BTC

- Users will need to sign up for paybase before Feb 1st 2014 to use it

- users will then need to sign up from Feb 1st to march 1st 2015 to use it

- All coins will be held in escrow to be bought by "a third party" in order requested

- A minimum of $10,000 (5,000 XPY) will be purchased back per month if someone goes through all the above steps

One user brought up a simple argument: why does Josh need our IDs to trade XPY for BTC? As it's not a Fiat transaction, the "know your buyer" anti fraud laws don't apply. In fact, BTC to XPY trades happen without verification all the time. As it's a purchase via escrow using cryptocurrency, there is no need for personal contracts outside of the basic terms of escrow and there's nothing in escrow that says legal verification is needed. The most common thought is simple: personal information is valuable. Josh plans to sell user information to recoup XPY payment losses. Users who have suggested this have all been banned.

"The Mage" (the guy who runs Litecoin) asked to have Litecoin removed from Coinswap stating that "there was an obvious significant conflict of interest between creating a crypto-coin and owning an exchange. In turn, this could give (and I believe they have done so) the parent company (GAW) the ability to artificially inflight the price". Wait, what's that link in this signature? Oh, it appears he's creating an exchange of his own! Well, that's not hypocrical or anything whatsoever. It also shows an amazing awareness of the events going on at exchanges right now. He also challenged Garza of GAW to a debate, of which no time or date has been set. Both camps are declaring that the other person is "too chicken" to actually debate, which is why nothing has happened. Wow, I love how this clearly isn't a pissing match between two guys who own coins and coin exchanges yet have zero idea how coin investment and trading works.

Beyond the pissing contests and posturing, there are the REAL companies like Amazon. When contacted by outside sources, Amazon outright stated that not only are they not working with GAW, that they will not work with GAW as they feel that GAW violates their terms of service. Amazon explained that "Any piece of software, extension or other system which implies a partnership or intercepts customers or customer information is in direct violation of our terms and Amazon will act accordingly." Guess what? The proposed "merchant program" does all of this. In response, the original Paysave program was scapped silently in order for it it be "reworked".

TL:DR

Garza was the biggest cryptocurrency scam troll ever on top of being the most inept tech-company "CEO" of all time.

- Used his real name on everything

- Made promises without looking at legality at all, claimed he had a "legal team" to advise him

- Over-hyped too soon: hype started November 2014, Paybase not slated to be finished until March 2015.

- Used a Pump and Dump on Paybase's release day, expected coin prices to be stable

- Released an unmarked open Beta, expected people to know it was a beta.

- Didn't test throughly to catch glaring day 1 security hole. Every released feature goes down at least once on launch day.

- Used 100% plug and play crap made by others with minor tweaks so it uses XPY

- Made wild claims about being affiliated with Amazon and other companies (something easy to disprove)

- The "Merchant Program" was a browser addon.

- Didn't read the TOS for the credit card processor. Took 10+ days to add plug and play Stripe script to site.

- Didn't use own currency on own site because "cart doesn't have an XPY plugin" yet the cart has a bitcoin plugin that could be edited.

- Can't tell the difference between trolls and crypto investors playing with a market

- Actually believes in DELETE FUCKING EVERYTHING and apparently doesn't know about Wayback Machine and other archives.

- Hardcoded wallet with special classes in it based on other existing wallet, leaves it open-source.

- Focused on as many loopholes as possible to not be sued, did so pretty poorly.

- Went "all-in" on this despite clearly having no fucking clue what he's doing.

- Wiped away all allegations of wrongdoing with NO U instead of proof.

- Later admitted to everything then added in the Russian and Middle Eastern mafias for the lulz.

See also

External Links

|

Paycoin is part of a series on Visit the Softwarez Portal for complete coverage. |